Investing wisely is one of the most effective ways to grow your wealth over time. Among the most popular investment options in India, the Systematic Investment Plan (SIP) stands out for its simplicity and compounding power. But how much can you realistically earn in 10 years by investing through SIPs? This blog will break it down step by step, helping you make informed investment decisions.

What is a SIP?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount regularly in mutual funds. Unlike one-time lump-sum investments, SIPs allow you to invest small amounts periodically (monthly, quarterly, etc.) and benefit from rupee cost averaging and compounding growth over time.

Why SIPs?

- Low initial investment

- Disciplined investing habit

- Reduces market timing risks

- Allows compounding to work over long periods

How to Calculate SIP Earnings in 10 Years

To calculate your potential SIP earnings, you need three key variables:

- Monthly Investment Amount – How much you plan to invest each month

- Expected Annual Return – Based on mutual fund performance (historical averages: 10–12% for equity funds)

- Investment Duration – In this case, 10 years

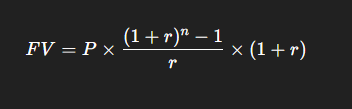

SIP Formula (Future Value):

Where:

- FVFVFV = Future Value of SIP

- PPP = Monthly Investment

- rrr = Monthly interest rate (annual return ÷ 12)

- nnn = Total number of months

Example:

- Monthly SIP: ₹5,000

- Expected annual return: 12%

- Investment period: 10 years (120 months)

After calculation, your future value (FV) will be approximately ₹13.5 lakh. This is the power of consistent investing and compounding!

Why SIP is Better Than Lump Sum

While lump-sum investing can generate higher returns if timed perfectly, SIPs reduce risk by averaging out market volatility. Even if markets dip, your SIP continues, buying more units at lower prices. Over 10 years, this strategy often outperforms poorly timed lump-sum investments.

SIP vs Other Investment Options

Many investors wonder whether they should stick to SIPs or explore alternative avenues. Here’s a brief comparison:

- Stocks: High risk, potentially higher returns, requires active monitoring

- Real Estate vs Stocks: Real estate is tangible but less liquid, while stocks/SIPs provide easier access and compounding potential

- Gold: Safe-haven investment, but generally slower growth than equity SIPs

By combining SIPs with other investments like gold or real estate, you can diversify your portfolio while earning passive income steadily.

Common Investment Mistakes to Avoid

Even with SIPs, investors often make mistakes that reduce their potential earnings:

- Stopping SIPs during market dips – Compounding works best over continuous investment

- Not reviewing portfolio regularly – Adjust asset allocation based on risk tolerance

- Investing without clear goals – SIPs are most effective when aligned with long-term financial objectives

- Ignoring other options like gold or stocks – Diversification is key to stable returns

Tools to Calculate Your SIP Earnings

Many online SIP calculators can instantly provide your projected returns for any investment horizon. These calculators consider your monthly SIP, expected returns, and time period, making financial planning easier and more precise.

Pro Tip: Use a SIP calculator before starting your investment to estimate returns and set realistic goals.

Conclusion

A SIP investment plan is a reliable way to grow wealth steadily over 10 years. By investing small amounts consistently, leveraging compounding, and avoiding common investment mistakes, you can achieve your financial goals with confidence.

Whether you want to invest in gold, explore stocks, or create diversified income streams, starting with SIPs is a smart first step. Remember, patience and consistency are the real keys to financial success.

FAQs:

1. Can I earn ₹1 crore through SIP in 10 years?

Yes, but you need to invest a higher monthly amount or choose high-return equity funds.

2. Is SIP risk-free?

No investment is entirely risk-free, but SIP reduces market timing risk compared to lump-sum investing.

3. How often should I review my SIP portfolio?

Ideally every 6–12 months to ensure alignment with financial goals.

4. Can I combine SIP with stocks or real estate?

Absolutely! Combining multiple assets can help diversify risk and generate passive income.

5. What’s the best SIP for beginners?

Equity mutual funds with long-term growth potential are often recommended for first-time investors.